omaha ne sales tax calculator

All numbers are rounded in the normal fashion. The most populous zip code in Nebraska is 68516.

Sales Taxes In The United States Wikiwand

Sales Tax State Local Sales Tax on Food.

. Sales Tax Rate Finder. The sales tax rate for Omaha was updated for the 2020 tax year this is the current sales tax rate we are using in the Omaha Nebraska Sales Tax Comparison Calculator for 202223. Real property tax on median home.

Salt Lake City UT. Wayfair Inc affect Nebraska. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. If this rate has been updated locally please contact us and we will update. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code.

Real property tax on median home. Omaha NE Sales Tax Rate Omaha NE Sales Tax Rate The current total local sales tax rate in Omaha NE is 7000. Omaha is in the following zip codes.

Long- and short-term capital gains are included as regular income on your Nebraska income tax return. Nebraska Capital Gains Tax. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

To calculate the sales tax amount for all other values use our sales tax calculator above. YEARS IN BUSINESS 402 334-6708. With local taxes the total sales tax rate is between 5500 and 8000.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Purchase Location ZIP Code -or- Specify Sales Tax Rate. As far as cities towns and locations go the place with the highest sales tax rate is Beatrice and the place with the lowest sales tax rate is Abie.

Real property tax on median home. How much is sales tax in Omaha in Nebraska. Sales Tax State Local Sales Tax on Food.

The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha Groceries are exempt from the Omaha and Nebraska state sales taxes. Select the Nebraska city from the list of popular cities below to see its current sales tax rate. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15.

Sales Tax State Local Sales Tax on Food. Sales Tax State Local Sales Tax on Food. Request a Business Tax Payment Plan.

Nebraska has recent rate changes Thu Jul 01 2021. The most populous location in Nebraska is Omaha. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts.

Also effective October 1 2022 the following cities. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

68022 68101 68102. Real property tax on median home. The Nebraska state sales and use tax rate is 55 055.

The Omaha sales tax rate is. Real property tax on median home. Nebraska NE Sales Tax Rates by City Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500.

The County sales tax rate is. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. That means they are taxed at the rates listed above 246 - 684 depending on your total taxable income.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Did South Dakota v.

All Zip Codes in Papillion Nebraska 68046 68133. Name A - Z Sponsored Links. The Nebraska sales tax rate is currently.

Sales and Use Tax. This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 7000.

Sales tax in Omaha Nebraska is currently 7. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. The state sales tax in Nebraska is 550.

Make a Payment Only. Taxes-Consultants Representatives Tax Return Preparation Health Insurance. 11422 Miracle Hills Dr.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 65 in Papillion Nebraska. Sales Tax Breakdown Omaha Details Omaha NE is in Douglas County. The one with the highest sales tax rate is 68310 and the one with the lowest sales tax rate is 68001.

Avalara provides supported pre-built integration. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Sales Tax Calculator in Omaha NE.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Sales Tax State Local Sales Tax on Food. Integrate Vertex seamlessly to the systems you already use.

The 2018 United States Supreme Court decision in South Dakota v.

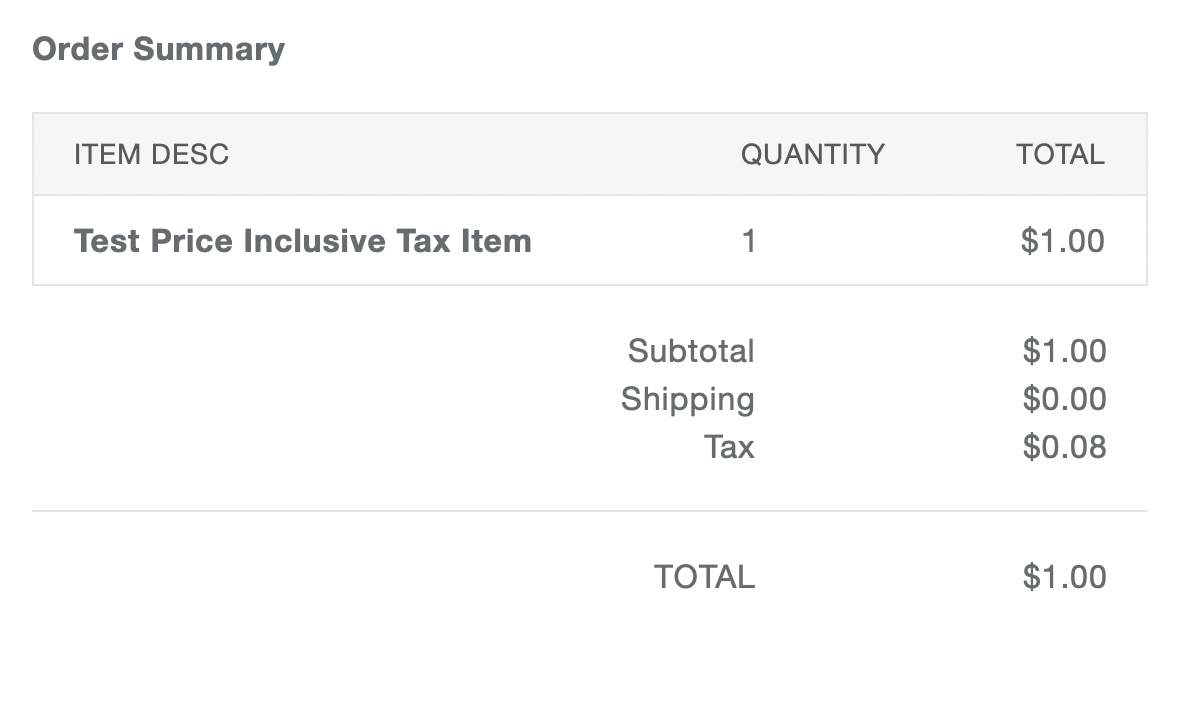

Square Online Tax Settings Square Support Center Us

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Nebraska Sales Tax Rates By City County 2022

Nebraska Sales Tax Small Business Guide Truic

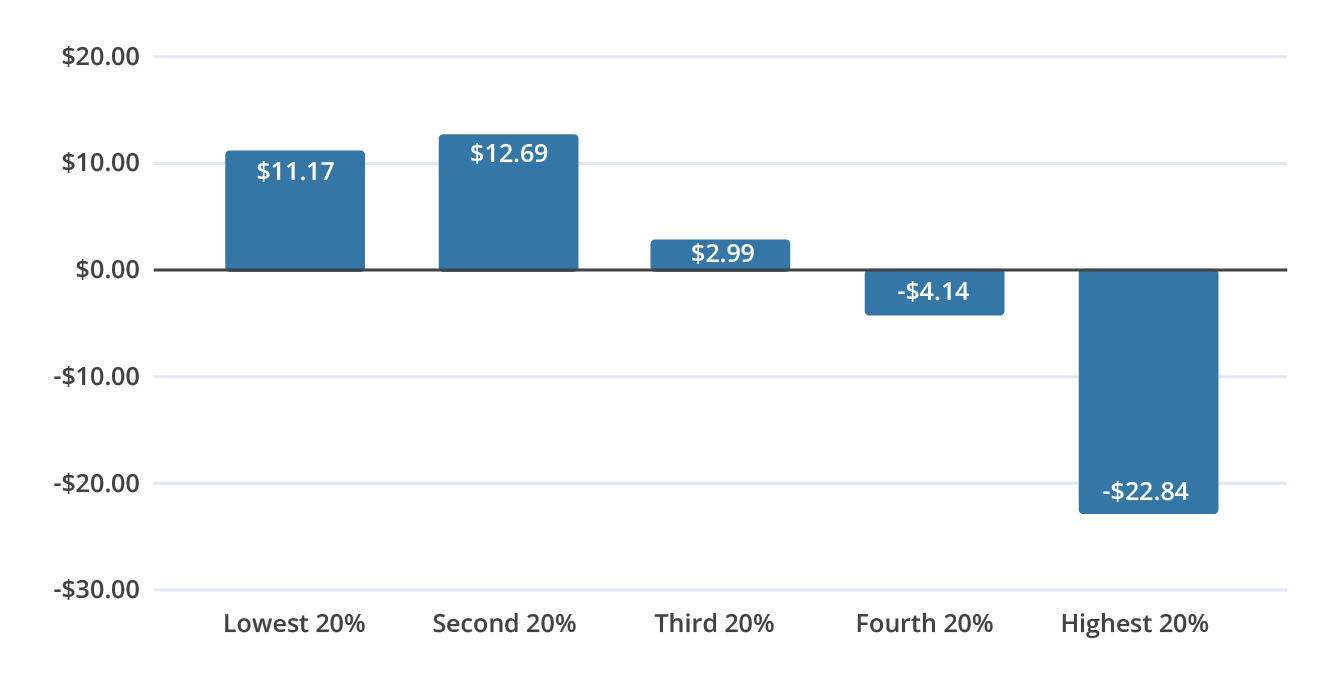

Carbon Taxes Without Tears The Cgo

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Nebraska Sales Use Tax Guide Avalara

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

Sales Taxes In The United States Wikiwand

Nebraska Income Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand